Client Stories

Nationale-Nederlanden in search of ideal insurance palette: product, price, communication

In this case, we show how we worked with Nationale-Nederlanden (team ING Verzekeren) to identify the optimal insurance palette for its private non-life products. This reveals, for example, that as an insurer, it is better not to include an Airbnb-cover as a standard cover in your product. Or that the no-blame-no-claim scheme deserves a lot more communication attention.

Let’s take an example

Suppose you start looking for household contents insurance. You can choose from dozens of providers with different products. But which one will make you happy? As an insurer, you would think that more is always better. So more coverage, more service, etc. However, the opposite is true. If they feel they are paying for something they don’t need, it makes the insurance less valuable.

The central starting point for mapping the ideal insurance portfolio is understanding the choice process and preferences of potential customers. Together with Flowresulting (now part of THoM), the ING Verzekeren team went in search of answers to these questions:

Fact-based approach to the right product offering

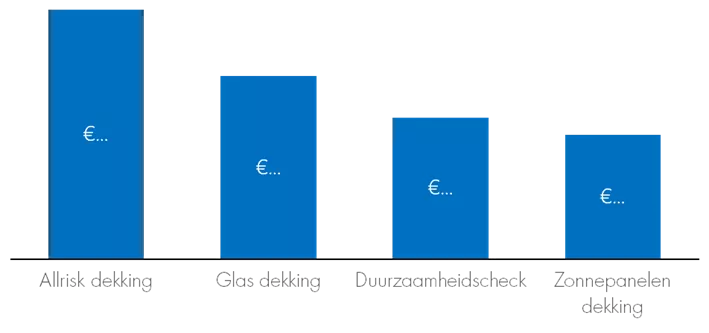

Quantitative research was used to understand the main criteria when choosing insurance (household, home, car, travel, liability, legal assistance and accidents). In addition, trade-offs between different value elements (e.g. coverages and services) of insurance were identified. Result: insight into the willingness to pay for cover such as all-risk or glass cover as part of a home insurance policy. This insight helps determine the right price for a product. In addition, ideas for innovation are tested as a possible part of the proposition. For example, we gain insight into the willingness to pay for a sustainability check as a new and distinctive service of an insurance policy.

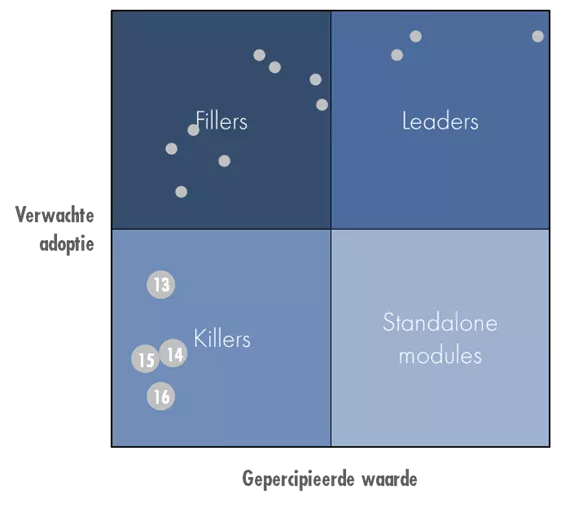

‘Killers’ have a negative impact on perceived value, but serve specific a target group

Adding covers and services does not always improve the attractiveness of an insurance policy. On the contrary: sometimes elements can even worsen perceived value. Using a ‘leader filler killer’ analysis, we gained insights into which elements these are for ING Verzekeren products. For example, it showed that covering your contents when renting out (e.g. via Airbnb) reduces value for many customers. In other words, if customers feel they are paying for something they do not need, this makes the insurance less valuable. Not everyone rents out their home via Airbnb, so this cover fulfils a specific need of a certain group of customers. Implication: it is better to offer this cover optionally because it serves a specific need of a niche target group (‘I want to be able to rent out my house with peace of mind’).

Valuable by-product of mapping the most important selection criteria: more targeted communication towards customers. An insurance policy easily consists of more than 20 product or service elements. For car a insurance, think of elements such as legal assistance or passenger cover, breakdown assistance in case of damage or a switching service when switching providers. Prioritising these elements helps ING Insurance to hit the mark on the website and in the My environment. Example: the no-blame-no-claims scheme turns out to be an important criterion when choosing car insurance. Despite this, few providers also clearly showcase this element, possibly because it is seen as a hygiene factor. Research into customer perception and to what extent it differs from reality helps ensure that key proposition elements get the attention they deserve.

“Based on the insights, we could immediately start working to improve existing content pages, on the one hand, and to implement concrete product and price adjustments, on the other. The insights and advice help us tailor the products more to the customer’s wishes and communicate in a more targeted way.”

Melvin ter Heerdt, Manager Customer & Proposition ING Verzekeren (Nationale-Nederlanden)

Result: optimised insurance palette and well-founded pricing

Based on the advisory process, not only was marketing communication improved, but ING Verzekeren was also able to improve the composition of its insurance products. In addition, concrete recommendations were made on the right pricing. These adjustments to the range contribute to products that make customers happy and also have a direct effect on returns.

You may also like

Discover smart tips, personal stories from our clients and our take on the latest marketing trends